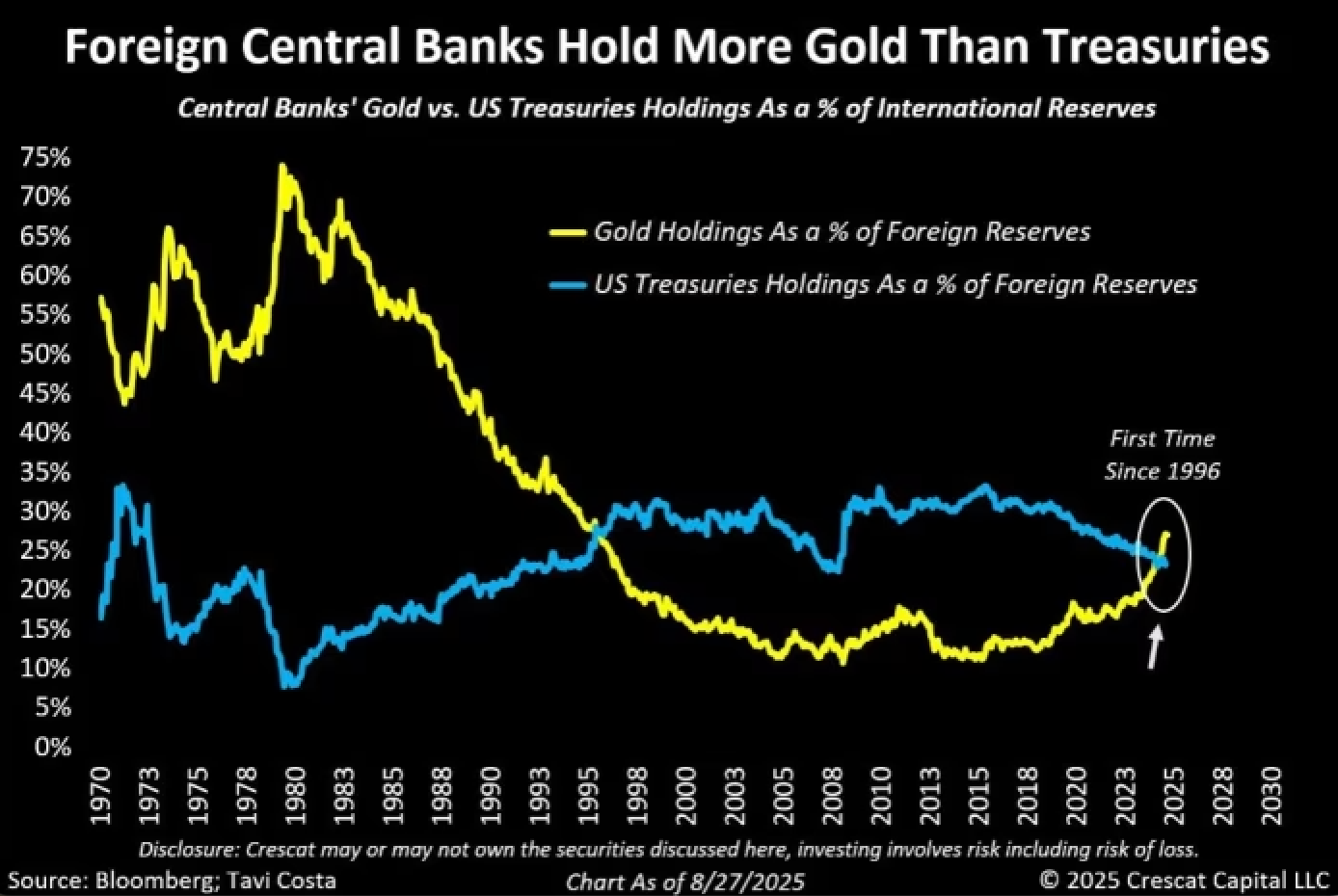

Central Banks Now Own More Gold than Dollars

Foreign central banks now own more gold than US Treasuries for the first time since Nixon gutted the dollar, setting off the decades-long central bank fire-sale of gold.

Is the end nigh for paper money and it's last man standing, the greenback.

What's causing the gold rush is two things: the political weaponization of the dollar and the catastrophic build…