Commercial Real Estate Threatens "Hundreds of Banks"

In case you've still got money in a bank, Bloomberg is warning that defaults in commercial real estate loans could "topple" hundreds of US banks.

Leaving taxpayers on the hook for trillions in losses.

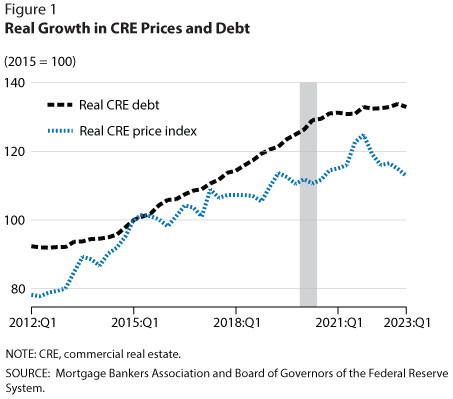

The note, by Senior Editor James Crombie, walks us through the festering hellscape that is commercial real estate.

Pre-Bailouts and Free Money

To set the mood…