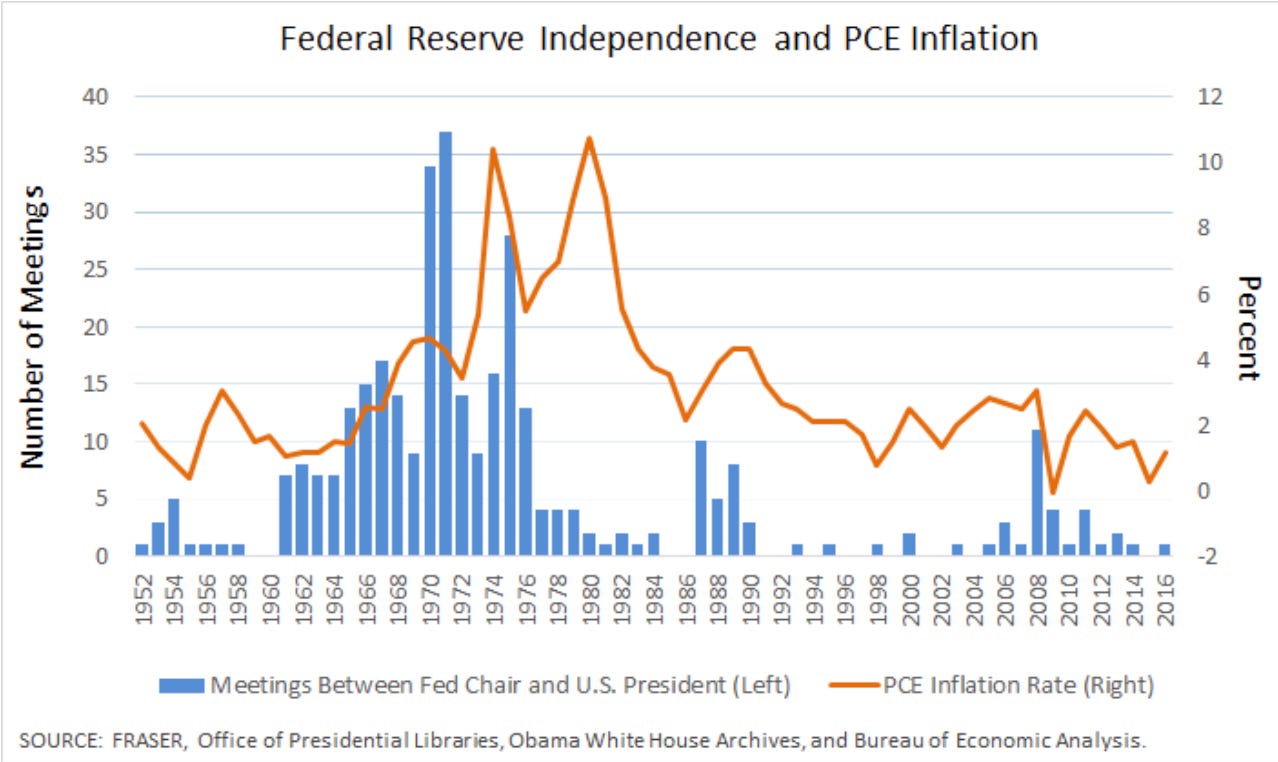

Does an Independent Fed *Raise* Inflation?

If Trump takes over the Fed will inflation get even worse?

Or is the Fed the heroic defender of hard money its defenders claim.

Last week Donald Trump fired fed member Lisa Cook for alleged mortgage fraud — the first time in the Fed’s 112 years a member has been fired.

Cook apparently has zero expertise in monetary policy — her academic career consists of …