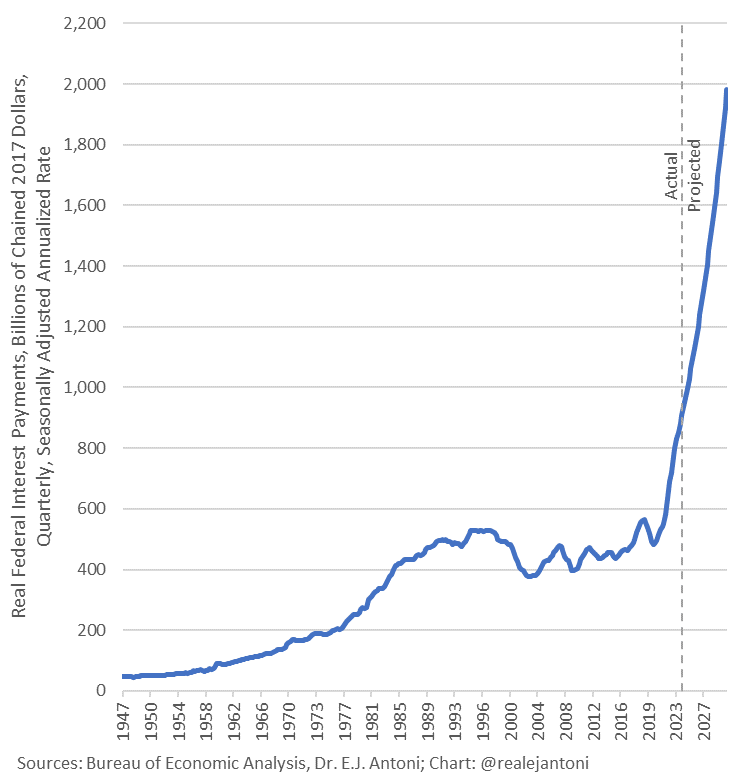

Federal Debt Interest Crosses $1 Trillion

For the first time in American history, interest on the national debt just crossed the one trillion dollar line.

In fact, it's projected to hit 3 trillion in just 5 years.

As Wall Street Silver asks, do you think we have a spending problem.

Our Debt Train Crash

First the numbers. Treasury reported that last month the federal government collected $324 billi…