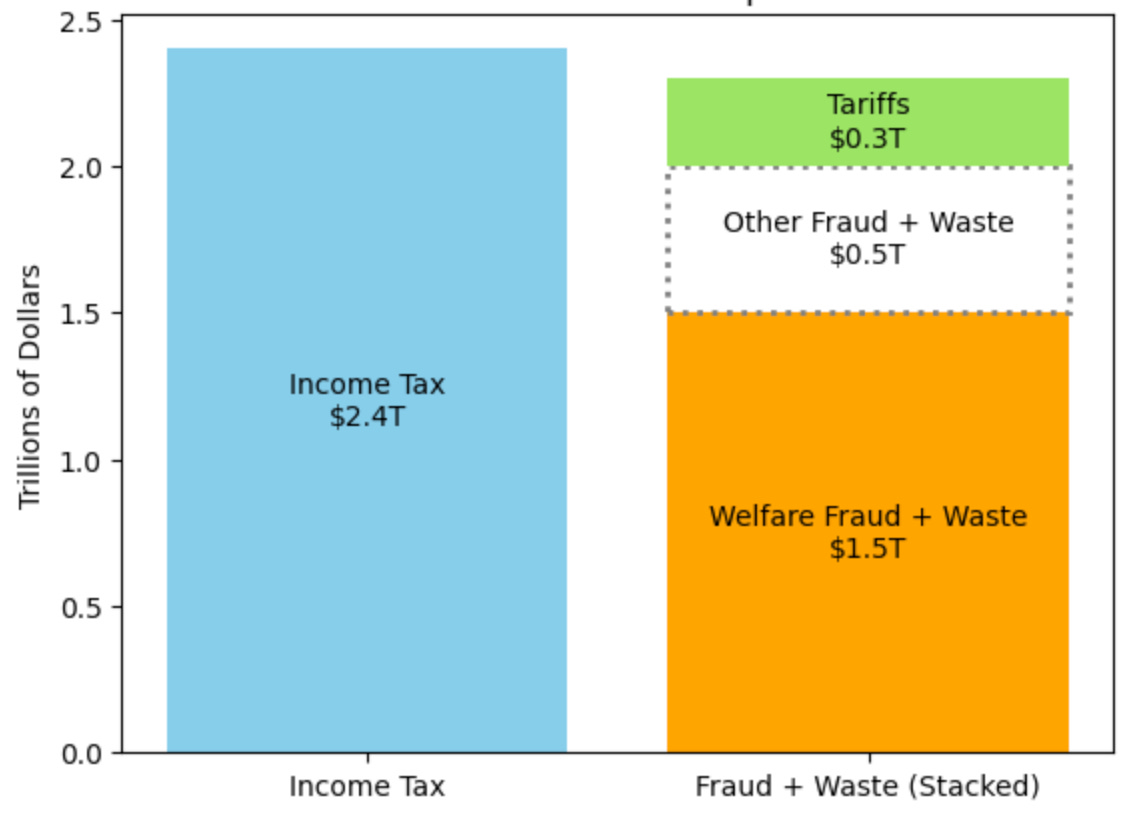

Federal Fraud Could End the Income Tax

A nationwide tax revolt is brewing in response to apparently industrial scale federal fraud -- of which Somali daycares are the poster child.

Raising questions why We the Suckers are still paying an income tax originally imposed as a temporary levy to finance World War One. Which ended some time ago.

And that apparently now mainly funds welfare fraud.