Florida Makes Gold and Silver Legal Tender

What does it mean for the dollar?

Florida just made gold and silver coins legal tender. Joining a dozen states making up one quarter of the population of our fair republic.

Is it the end of the road for the confetti the Federal Reserve prints in the basement.

Florida’s new legal tender law is set to kick in this year, recognizing gold and silver coins as legal tender for buying and selling, for debts and taxes, and expliclty protecting contracts made in specie -- as in selling a container of sham-wows for an ounce of gold.

Florida joins a dozen states including Texas, West Virginia, and Arizona that have passed similar laws.

In all cases, you’re not required to use gold and silver -- both sides have to agree. So it’s parallel money to the infamous federal reserve note.

And, like the dollar, it means no capital gains tax -- if you like your gold you can keep your gold.

What it Means for the Dollar

Alas, states can only do so much: For gold and silver to replace the dollar you need Washington to open the banking system.

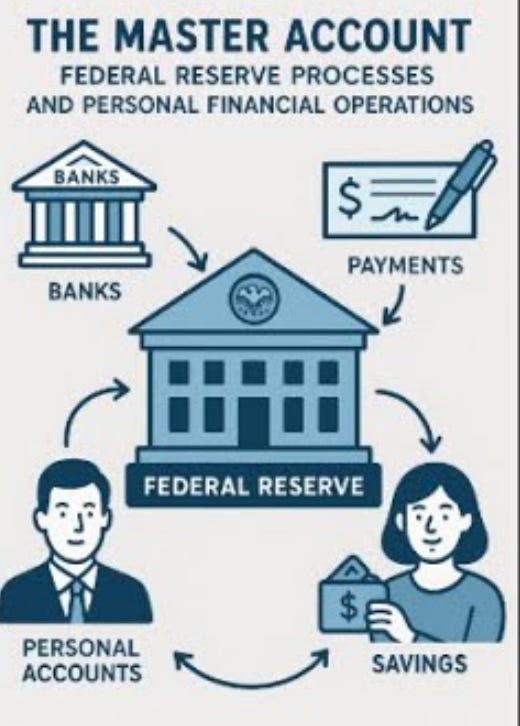

Specifically, equal treatment of gold and silver bank accounts, and the all-important Federal Reserve Master accounts that allow banks to move money with each other -- called clearing. And to access ACH so you can pay your mortgage from your bank account.

Without that, gold and silver will remain fringe. With near-zero impact on dollar demand — hence on the dollar itself.

Of course, the Fed and legacy banks will fight this with everything they’ve got. Because the Fed can’t print physical gold or silver. If you can’t print, you can’t bail out. Ending the Fed’s permanent bailouts of fractional reserve banking that feeds your life savings into the Wall Street inflation factory.

Printing Money from Thin Air

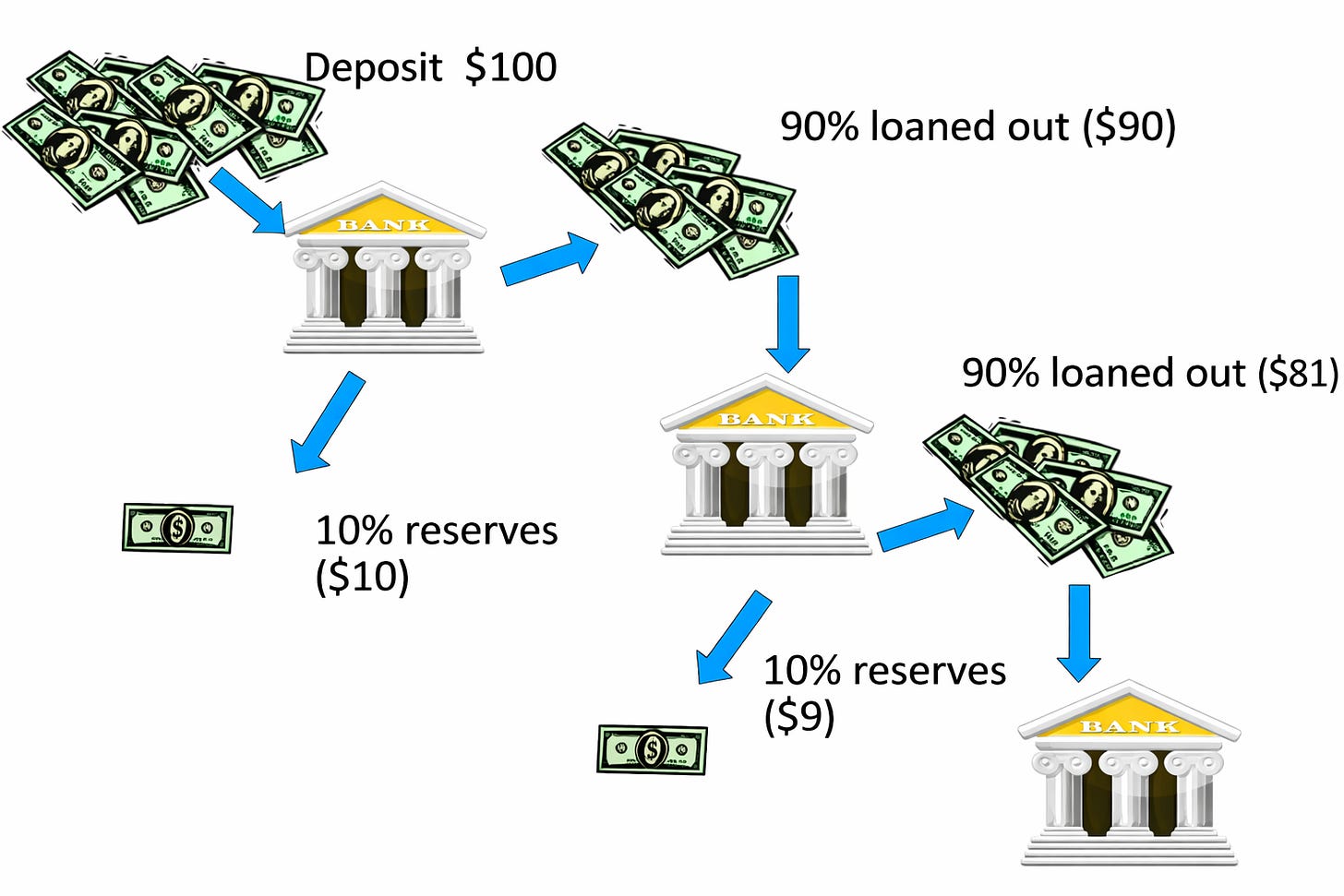

To illustrate, today when you get a loan or mortgage, the bank requires you to open an account at that bank. You might think that’s weird -- you want a loan, not an account.

But the reason is the bank is not handing you money from the vault, it’s literally printing the dollars from thin air.

And it can do this because the Fed promises to bail it out if it runs out of cash.

So a counterfeiting cartel. Siphoned directly out of your pocket.

Of course the Fed also gets in on the action, printing their own money in the basement, called Quantitative Easing or QE.

But most of the money printing is Wall Street. And gold and silver break this.

Wyoming’s Caitlin Long actually tried this, opening a full reserve bank in 2020-- Custodia -- that held 100% of deposits in the vault.

In other words, what people think banks do.

She got a license from Wyoming. But was shut out by the Fed and OCC, who know it would gut Wall Street.

After all, why would anybody park money in a bankrupt casino that’s lent out ten times its cash when you can park it in a vault.

What’s Next

Getting back to the gold standard -- or gold and silver “bimetallic” standard -- is ideal. But historically it takes a major crisis. Meaning the most viable path is parallel currencies — gold, silver, or Bitcoin competing on an even playing field.

One in four states are on-board for gold and silver. Now it’s up to Trump to direct banking regulators — and Congress to open Master accounts — to level the playing field.

If they succeed, it blows a hole below the waterline of the fractional reserve boom-bust factory that puts Americans on food stamps to keep Wall Street in hookers and yachts.

Each week I write on Economics and Freedom. Consider joining over 22,000 subscribers and becoming a free or paid subscriber to support my work.

Every day I also make 3-minute videos on economics and freedom:

20 minute Roundup Podcast of all the week’s videos: Search Peter St Onge on all major podcast platforms.

Dr. St. Onge, you noted about that "And, like the dollar, it means no capital gains tax -- if you like your gold you can keep your gold." By this, you don't mean that when you purchase something in Florida with appreciated gold, there is no federal capital gains tax on the gold?