GDP Goes Negative. And it's Glorious.

It's official: GDP is negative.

And it is glorious.

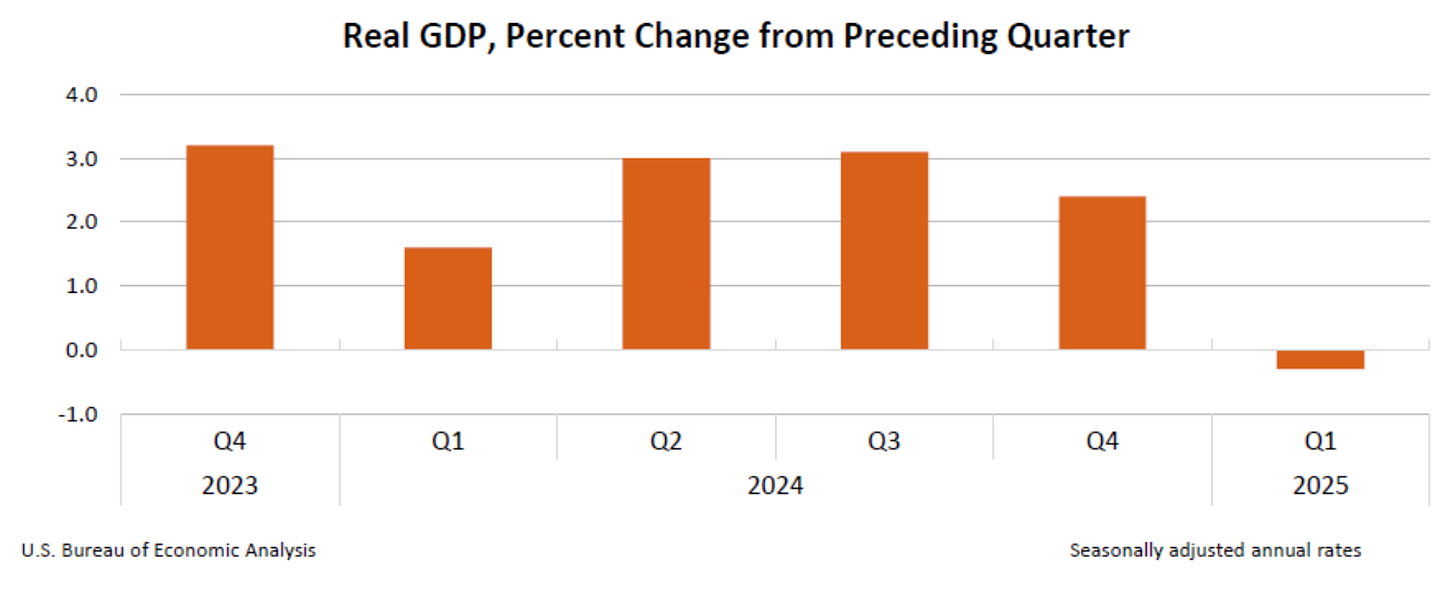

Last week the Bureau of Economic Analysis reported that GDP for the first 3 months of 2025 turned negative for the first time since 2022.

The kicker is all the pain was caused by a 41% surge of imports front-running tariffs. Which GDP bizarrely counts as negative GDP.

Drop those and actual GDP soared by a …