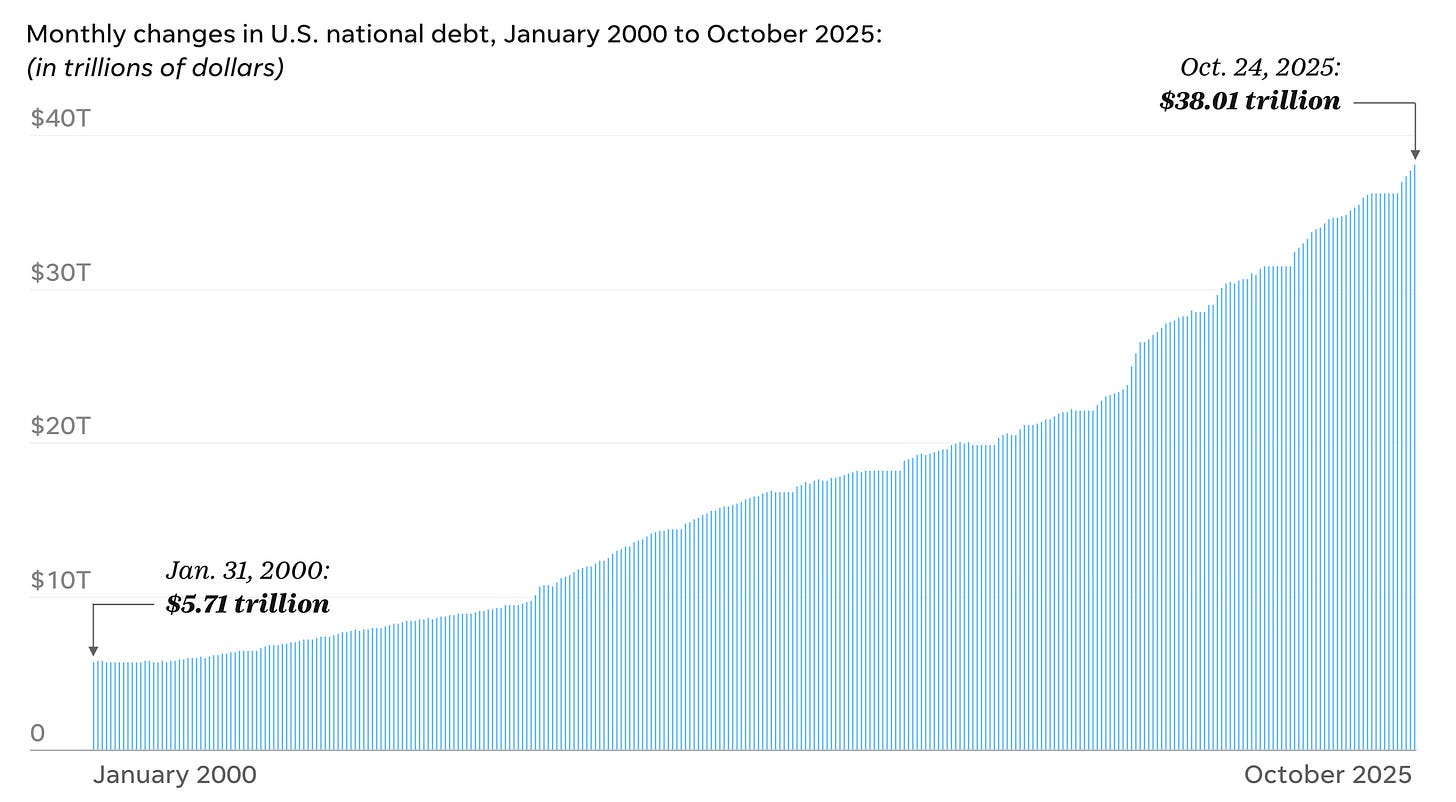

National Debt hits $38 Trillion

The national debt just hit $38 trillion.

Just 2 months after we crossed 37.

Congratulations, Congress. You earned it.

38 large comes to $287,000 for every household in America. With another $140,000 in private debt.

My friend Richard Stern calls the national debt a second mortgage on every American. Now it’s a second and third mortgage.

Coming just 2 months…