Recession Cancelled but Fed Keeps Strangling

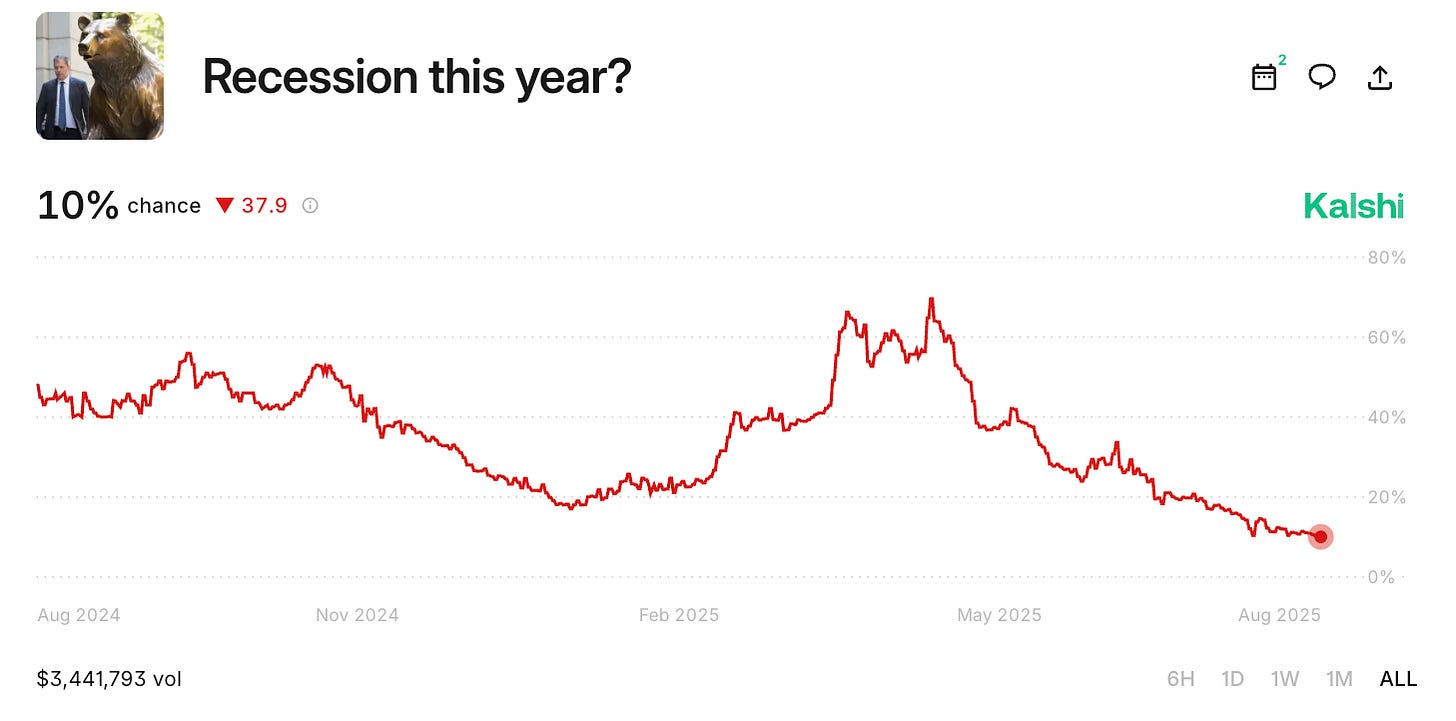

The tariff recession is cancelled but with the Fed strangling rates we are nowhere near the boom Trump wants.

So say a pair of heavyweight numbers that dropped last week: GDP and jobs.

GDP came in at a very respectable 3% -- which is solid boom territory.

Meanwhile, private sector jobs hit a hundred forty thousand on the month -- reversing the previous mon…