Why "Experts" Got Trump Inflation Wrong

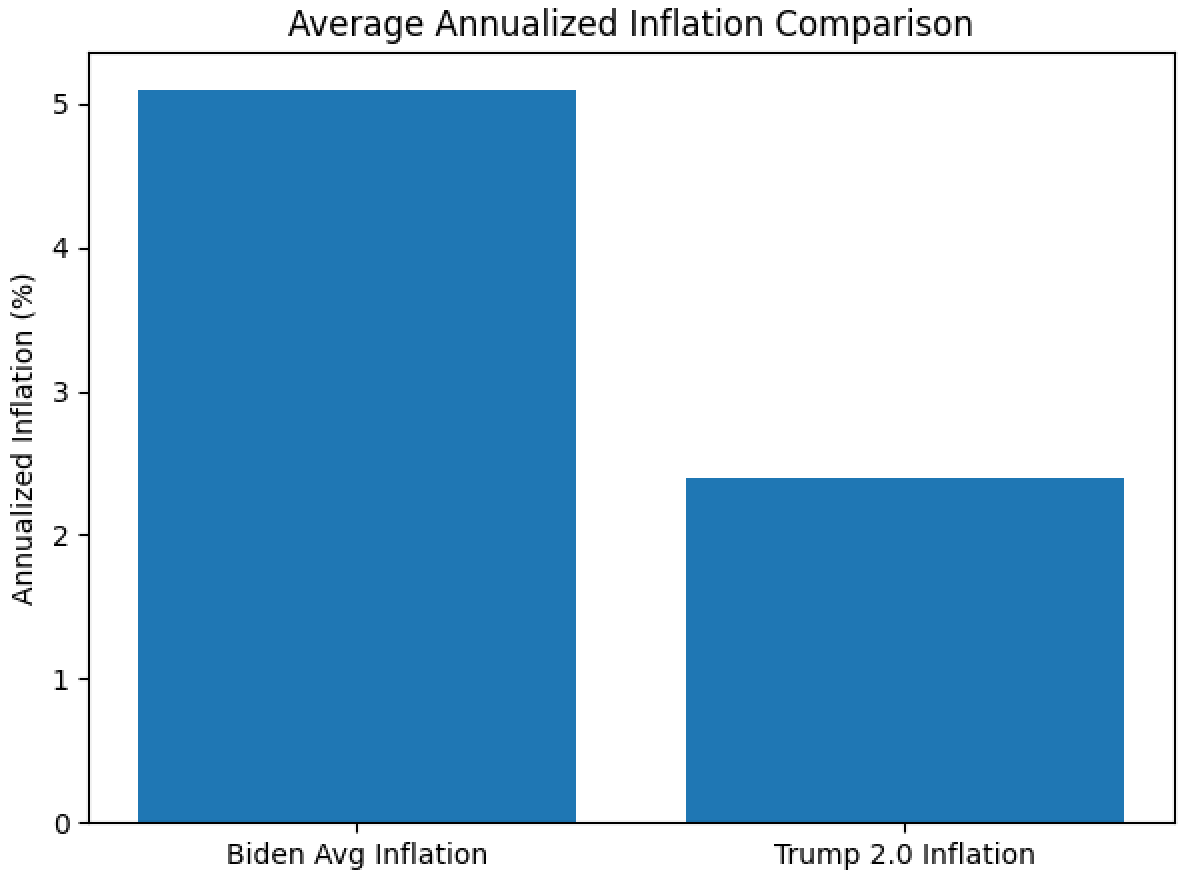

“Experts” predicted inflation would soar in a second Trump term. Instead, it crashed.

Prices are still high, of course. But we’re actually flirting with deflation with inflation under 1% according to real-time price tracker Truflation.

So why were the experts so wrong: Was it pure bias.

Or are left-wing Keynesian models garbage?

Before the 2024 election, CNN ran an open letter by no less than 16 Nobel Economists — one in three living laureates -- warning inflation would rise under Trump from the 3% it was running at the time.

In fact inflation went down under Trump. It’s currently running 2.4% year-on-year but actually under one percent according Truflation, which more accurately tallies the drop in housing prices and rents.

The “Expert” Predictions

Their argument was tariffs would be passed on to consumer, which didn’t happen in Trump’s first term nor his second -- the Chinese ate them both times

But the big one is their models said Trump would grow the economy too much. Namely, that his $4.8 trillion of tax cuts in the Big Beautiful Bill would combine with degulation to “risk accelerating the economy when the Federal Reserve is working hard to slow it down’

As in the Fed was dutifully strangling the economy but President mean-tweets would make it grow too fast.

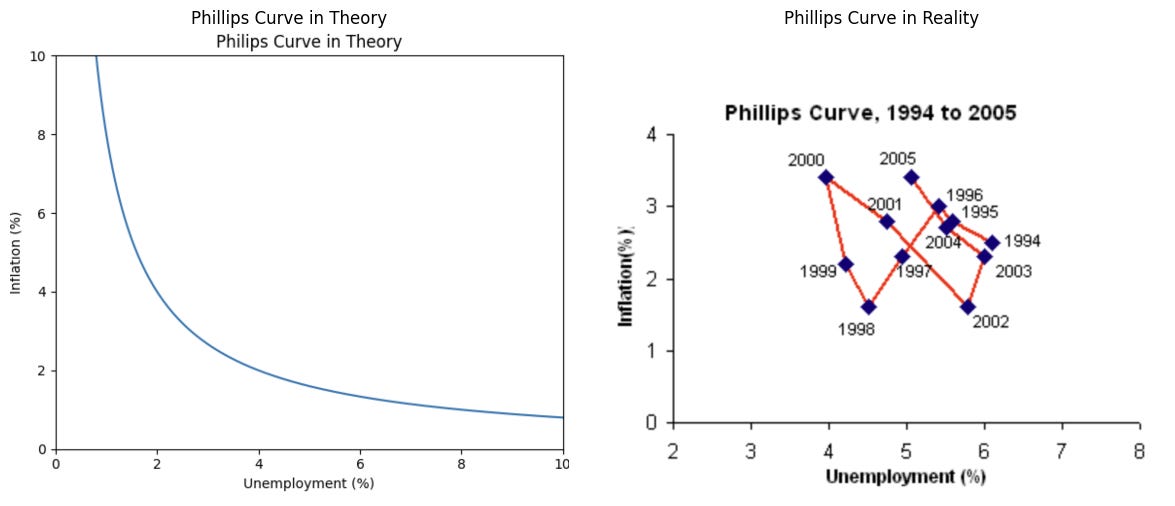

So in standard Keynesian there’s a trade-off between growth and inflation, called the Philips Curve. It says if the economy grows fast you get inflation -- it supposedly overheats. So the solution is strangle.

This is garbage. Because classical economics -- and Austrian economics -- say productive growth reduces inflation. While unproductive government spending -- Somali Learing Centers, windmill subsidies, welfare for illegals -- are inflationary.

Keynesians can’t see this because they’re effectively correlating inflation and GDP — using unemployment as proxy. As Elon famously noted last year, you could fire all the car workers, replace them with twice as many DMV workers staring out the window at twice the pay, and your GDP — and jobs — would go up.

Why Production Lowers Infaltion

To see why production lowers prices, imagine a big pile of all the money circulating — circulating as in exclude savings, which are salted away for a rainy day where they don’t chase prices up.

So a big pile of circulating money.

Then take all the stuff for sale in another pile. Divide them and presto: dollars per stuff.

If money is growing faster than stuff there’s too much money and prices go up.

But if stuff is growing faster, it takes fewer dollars to buy a widget. Prices go down.

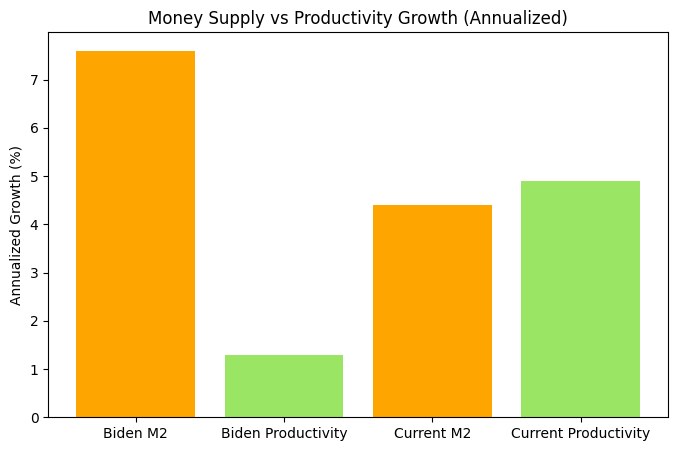

That’s exactly what’s happening right now: M2 money supply is growing at 4.4% but productivity is growing at 4.9%. The stuff’s growing faster than the money. Which is trending us towards deflation.

Incidentally, the main reason M2 is slow is federal spending’s growing at just 2% -- compared to 11% in Biden’s last year. Federal spending is on what passes for a diet in Washington.

This explains why left-wing economists and politicians actively try to strangle the economy: In their mind strangling the private economy leaves more inflation for government to spend.

But in reality they’re shrinking the entire pie plus making total inflation worse. Stagnation plus inflation — stagflation.

What’s Next

The Philips Curve inflation-growth tradeoff has been wrong since Milton Friedman savaged it in his 1967 “The Role of Monetary Policy.”

But socialist universities -- and socialist Nobel Committees -- keep pushing it to grab more of the productive economy for the government who pays their salary.

Meanwhile, the collateral damage -- the inflation and the strangled wages -- hits other people, especially blue-collars they probably enjoy seeing suffer.

If Trump’s investment-led boom continues while Congress keeps deadlocking spending growth inflation will stay tame all year.

Alas, we’re still not out of the woods — $2 trillion deficits keep marching us towards the bond-market apocalypse. Which the “experts,” in all likelihood, will miss again.

Each week I write on Economics and Freedom. Consider joining over 22,000 subscribers and becoming a free or paid subscriber to support my work.

Every day I also make 3-minute videos on economics and freedom:

20 minute Roundup Podcast of all the week’s videos: Search Peter St Onge on all major podcast platforms.

The accuracy of the so called “experts” is laughable. It seems more evident now than when I was younger, that experts are actually just sales professionals for a specific narrative. Propaganda is their sales pitch!

Inflation is a monetary phenomenon, but bad fiscal policies, such as Joe Biden and the Democratic Congress's inflation of the money supply by 40 percent in two years without a corresponding growth in productivity, were the main driver of 9 percent inflation. Stopping the spending, along with deregulation and other pro-growth policies, has obviously lowered inflation.