How to Restore the Gold Standard

Can we save the dollar before central banking kills it?

Our deficits are now stuck at 8% of GDP — unprecedented in peacetime. And our national debt just hit $35 trillion — unprecedented in the history of man.

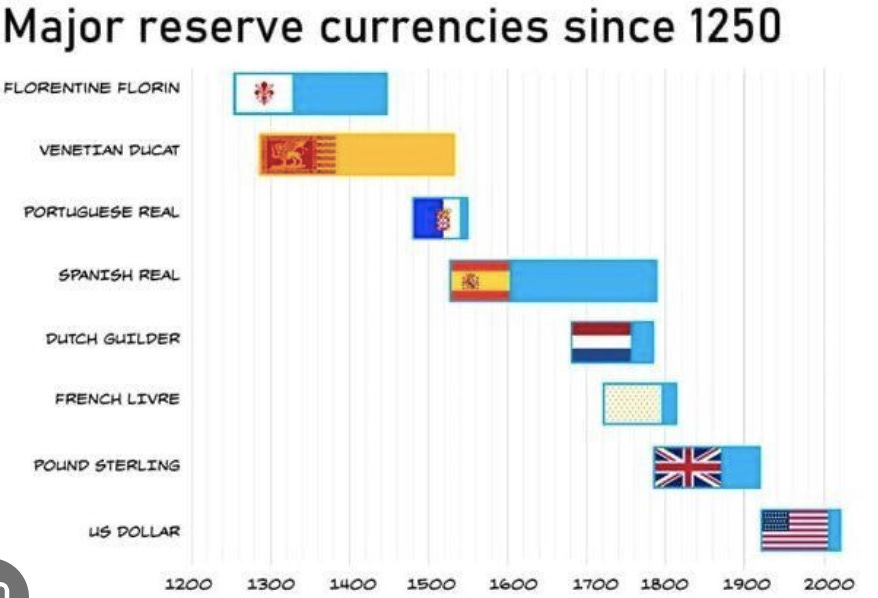

Even the central bankers realize that this isn't sustainable. That we are coming to the day our paper money utopia crumbles.

Historically, from Song…